Clerical post is a very honorable position offered to candidates who clear Bank Clerk Exams. A Bank Clerk is answerable for a great deal of client services provided at different Banks. Banking sector is the foundation of a nation’s economy and Bank Clerk fills in as the building block of this essential sector. Being a front office job, a Bank Clerk plays a fundamental job in giving the best service to the clients. Many of the aspirants by practicing huge amount of sbi clerk mock test clear this exam.

This job is vital to a bank branch’s operations, as bank clerks are the first people of the bank work force that the clients interact with. Furthermore, bank clerks keep up with the significant customer and financial records to guarantee that the bank branch stays efficient and adheres to reporting financial administration laws as well as guidelines.

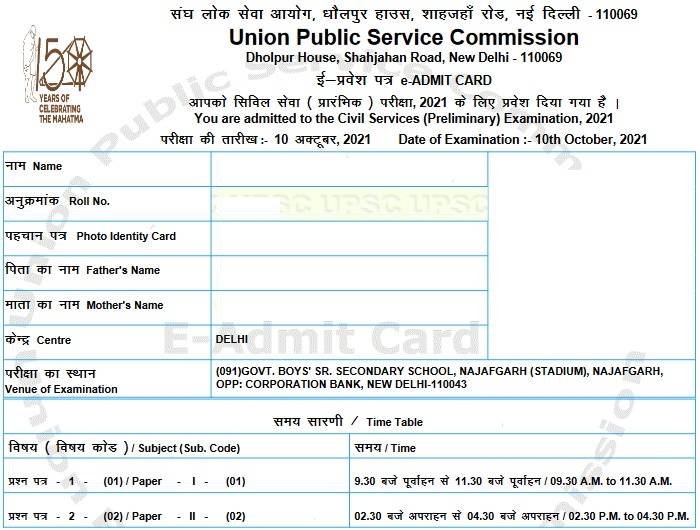

SBI Clerk Results have been delayed because of the complete lockdown in India due to the corona virus outbreak. The results will be announced by the State Bank of India (SBI) on their official website – http://www.sbi.co.in.

SBI Clerk Cut Off will be released in an arrangement, for example Cut-Off for Preliminary Exam will be initially released followed by the Cut-Off for mains Exam. The cutoff depends on factors such as the number of candidates showing up for the test, difficulty level of the examination, average number of attempts undertaken by the aspirants and the number of vacancies in each state.

Bank Clerk Skills

SBI clerk balance client assistance with administrative undertakings. The following skills are performed by bank clerks on a regular basis.

Client Service – This is the majority of the job for a bank clerk, particularly for bank tellers it includes giving phenomenal client assistance to bank visitors, so an active and inviting attitude is necessary.

Attention To Detail – Bank Clerks offer managerial support across various divisions, so they have to give close attention to client data, individual transactions, and cash reporting.

Organization Skills – This job likewise requires an elevated level of organization skills. A bank assistant is responsible for keeping up with client and transaction records, tallying money, and checking budgetary data without making any blunders.

Data Entry – Bank Clerks ought to likewise be skilled with data entry, since they have to rapidly and precisely enter and update client and financial data in banking frameworks.

Bank Clerk Duties and Responsibilities

Bank assistants bolster banking activities through a wide assortment of managerial and client service errands. The following are some of the crucial duties and responsibilities undertaken by bank clerks.

Process Customer Transactions

One of the bank clerk’s primary obligations is processing client exchanges. Bank tellers are the clerks who will in general handle this obligation the most, however clerks from different departments every now and then need to offer help and support in order to guarantee a positive client experience and decrease waiting time substantially. These transactions range from deposits and withdrawals to loan payments and requests for cashier’s checks.

Answering Visitor’s Questions

Bank clerks likewise support positive client experiences by responding to client inquiries concerning financial balances, credit cards, and loan details. They may provide clients with data about explicit account amenities and charges incurred to get those details. Bank clerks additionally answer inquiries concerning bank policies and working hours.

Directing Customers to Bank Personnel

Bank clerks help clients by guiding them to banking associates. If a client comes in for a meeting with a loan official, for instance, a bank clerk invites that client and informs the loan official of the client’s arrival.

Checking Personal and Financial Information

Many bank clerks work in a specific department as loan or credit representatives. These clerks undertake bank activities by verifying client’s data during the application process, providing loan officials or security personnel with pertinent financial information to make loan and credit choices. Credit clerks may likewise contact other financial establishments to assemble and check monetary data. Tellers additionally every now and then need to confirm client data to process the transactions.

Maintaining Customer and Financial Data

Bank clerks enter and update client and financial information in the bank’s PC frameworks dependent on client or manager’s requests. This can incorporate updating a client’s address or contact data, making changes to client’s income records, or expelling clients from bank records when they close their accounts. Bank clerks also enter bank-related data in databases to support financial reporting.

Support Cash Management Activities

Bank clerks assume a significant role in management of cash. Tellers keep complete records and ensure that their cash drawers are balanced all through their shifts. Vault clerks supervise daily cash deposits and verify amounts to keep an accurate check on cash deposits and reserves. Bank clerks who work with money need to promptly report any disparities (shortages or overages) to their superiors so that mistakes can be immediately amended.